Rain Credit platform

Rain Credit is a BEP20 token on the Binance Smart Chain that acts as an aggregator for offline data analytics, providing a concise credit rating for a user's address. This credit rating is used to provide the best collateral for lenders and borrowers of digital assets on the Rain platform. Rain Credit is based on current decentralized lending platforms and protocols, but with various changes that provide even more innovative designs and capabilities.

Features of Rain.Credit:

-Oracle Analytics

-Offchain -Digital trust

-Non-custodial lending

-Credit rating

-Trusted

network -Compatible with Binance smart chain / ethereum

Oracles solve the transparency problem faced by many Defi projects. By removing information from the chain and providing data in a consistent way, Rain.Credit Oracle enables smart contracts to extract data from blocks containing the information it needs. The information transmitted by the Rain.Credit oracle will include things that cannot be tracked or controlled by the blockchain. This includes the history of user payments across multiple chains, real economic events, government policy changes, and the history of user accounts.

Rain Loans is a non-custody digital asset lending and borrowing platform. It is based on a composite protocol with modified asset pools and the use of Rain + to increase access to additional funds beyond the current CDP offered by Compound Finance, AAVE & CREAM.

Rain + is an additional amount of tokens that we offer to borrowers through our platform without providing any additional collateral, based on their transaction history and rating from Rain Off-Chain oracle analytics.

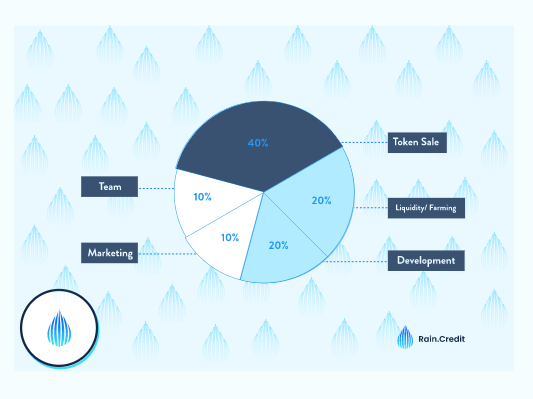

Tokenomics

The distribution of tokens is as follows:

40%: will be sold on a pre-sale basis

20%: will go towards the development of the project

20%: will be used to provide liquidity and yield

10%: tokens will be allocated to the team (within 2 years these tokens will be locked to instill trust in the community)

10% : will go to marketing

Rain.Credit Roadmap:

Q2–2021 (Testnet Season)

Our goal in Q2 2021 is to get the platform fully operational in a short time so that the Oracle and Lending platform will run efficiently on the testnet. We also strive to further develop the Oracle platform by creating a “web of trust” that motivates data providers.

$ RAIN Token Presale

Stock Listings

Offchain Aggregation on Oracle Analytics

Testnet Lending Platform Testnet. Testnet of

Trust

Deflationary Staking and Farming

Launch Q3-2021 (Mainnet Season)

Our goal at the start of Q3 2021 is to launch the platform at full strength with Oracle and Lending migrated from Testnet to Mainnet within a short period of time. We are also looking to further develop the Oracle platform with the launch of the Trust Network, which encourages data providers.

Contract Audits, Lending and Oracle

Offline Oracle Analytics Mainnet

Lending Platform

Aggregate Data Providers

Network of Trust

Hackathon RAIN Oracle

Q4–2021 (Middleware Season)

This quarter will be heavily focused on middleware integration and an exciting period for our communities with the launch of RAIN drops Governance DAO.

Oracle Network Release 2.0 (in addition to aggregated analytics)

Off-chain release Oracle Marketplace with multi-chain support

Launch of RAIN abstraction layer GraphQL

RAIN DAO

management Offline asset management and monitoring

platform release Offline asset management and monitoring platform release (one-click integration with platform, not blockchain-based)

Comprehensive API and documentation

release Q1–2022 (cross-chain season)

The first quarter will focus on cross- chain integration outside of the Ethereum network with the aim of making our services available across multiple blockchain networks.

Secured lending between networks

Launch of cross-chain Oracle

Smart contract analytics platform Cross-chain

trust assessment (outside of the Ethereum network)

Assets group trust assessment

Continuous development and improvement of the Trust Network

Academic research and publication of trust assessment results in the DeFi sector Rain.Credit Rainbuilder

team

/

Hail Lead Developer / Developer

Drizzle /

Monsoon Community Manager / UI / UX Designer

Rain.Credit seizes the opportunity to create a more robust ecosystem and also provides an incentive to engage in borrowing and lending to improve a user's credit rating. Using off-chain analysis to build confidence in lending and borrowing in the defi space is something that was not explored prior to loan processing. With the ability to use real information and events as a factor in decision-making, users can worry less about reliability, reliability, higher collateral factor and focus on using their assets to increase their portfolios by participating in an innovative and groundbreaking platform.

More information about the project:

Website: https://rain.credit

White paper: https://rain-credit.medium.com/rain-credit-off-chain-analytics-aggregation-oracle-the-white- paper-5901515068dc

Telegram: https://t.me/joinchat/UqEl0GyJZ4WkDUWR

Github: https://github.com/orgs/Rain-Credit

Medium: https://rain-credit.medium.com/

Twitter: https: / /twitter.com/rain_credit

Discord: https://discord.gg/aEc7NWbU

Bitcointalk username: syedrasool2020

Comments

Post a Comment