Savix definition

Savix, virtual currency is now available for the first time, making it possible to profit from reward rates while maintaining an unlocked and liquid token that can be used for free on any DeFi product at the same time.

Benefits for currency holders:

Multi-Beneficiary

Since the Embedded Staking Protocol (PES) ensures full availability of tokens in other DeFi products, the rewards can be “doubled” with Savix. Thus, betting rewards are an additional layer of passive income. The forthcoming Trinary Liquidity Incentive Program (see 7) will offer Savix holders another very special additional source of income.Convenience

Savix betting is built into standard ERC20 transfer features, is fully automated and 100% passive, so no decision or user interaction is required to receive rewards.Flexibility

Savix is compatible with any Ethereum-based DeFi project. Savix coins can be used, like all standard ERC20 tokens, for pooling, lending, growing crops, mining. At the same time, continuously providing holders with additional tokens for betting.Satisfaction

Savix's embedded protocol rates evenly adjust all balances according to the embedded offering curve (see 3). No preference is given to any particular holder. All wallets are treated in the same way, regardless of balance, transaction volume or other parameters.Transparency

Savix sources are open source. All programming codes and contracts are available through Github and can be verified and tested by anyone. In connection with the deployment of a single contract, any manipulations with the logic of the contract or the maximum offer are impossible, there is no minting of additional coins. Staking rewards are completely transparent and predictable.Stability

Savix does not have any reward events at the end of lock periods that could generate cyclical dumps. Except for market reasons, selling Savix is never easier or more profitable at any given point in time, which reduces volatility.Independence

With Savix, you remain independent because tokens are always liquid, earning rewards (no blocking), and can be freely moved or invested in DeFi products.

These features are made possible by the unique Inline Staking Protocol (PES), which implies the ability to invest in high-yield DeFi products with predictable backing from conservative staking.

Briefly about the features of Savix:

- embedded betting protocol

- compatible with any DeFi project

- fully automated - 100% passive

- unique project (no copy / paste)

- real-time rewards

- additional level of passive income

- completely transparent working mechanism

- resistant to manipulation

- Artifact ready to be deployed

Using Savix, investors can receive triple rewards:

● ETH and Savix from the Uniswap commission share

● Savix from the built-in ERC20 betting protocol

● ETH from the Savix "Trinary" pool

To implement the stacking features mentioned above, the ERC20 protocol has a stacking mechanic built in. The algorithm works by regularly increasing the total number of tokens in accordance with the mathematical logic implemented in the smart contract. Account balances are determined by their individual share in the total supply, which guarantees a non-dilutive distribution of tokens. Thus, the relative staking profit remains and remains the same for all accounts, regardless of size and user-related parameters such as staking duration, stake pool selection.

The mathematical logic behind the built-in stacking of the Savix protocol has the following characteristics:

● Transparent supply calculation, predictable for investors.

● Calculation stability with respect to user behavior and network effects.

● Efficient calculation of computing power and transaction costs.

The following chart shows the Savix supply curve normalized to a total supply of 1.

To set specific incentives to buy and hold, early investors are rewarded in the form of daily interest rates in excess of 2% during the first days after betting starts. If you start with an investment of 100 Savix (SVX) that you purchase before the betting mechanism is activated (right after the start of Uniswap trading), you can expect to be rewarded according to the table as follows:

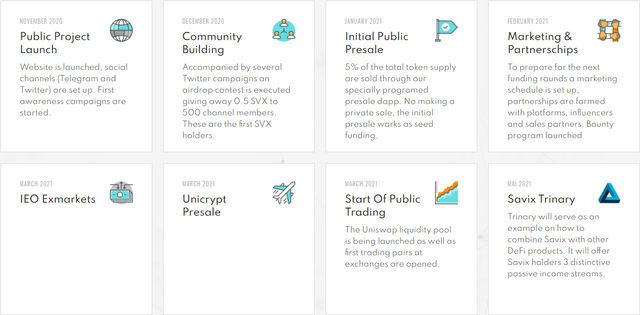

Project roadmap:

Project partners:

Token distribution and budget distribution:

TOKENONMICS & TOKEN SALE•

The introductory price of the SVX token at the market will be 50 SVX / ETH. A private sale will not be executed. Public presale will be spilt into three phases, each phase – and possible sub-phase - having different discounts and processors. The public sale will start at Uniswap first and then be extended to traditional exchanges for increasing the reach of the token.

•Token Distribution & Budget Allocation •

√ 5% Initial Public Presale

√ 20% IEO Launchpad

√ 40% Unicrypt Presale

√ 20% Uniswap Liquidity (Public Sale)

√ 7% Ecosystem Fund

√ 3% Bounty Program

√ 5% Team

BUDGET ALLOCATION (ETH):

√ 36% Uniswap Liquidity

√ 7% Ecosystem Fund

√ 30% Further Development

√ 17% Marketing

√ 10% Reserve

•Initial Public Presale•

GENERAL CHARACTERISTICS OF THE INITIAL PUBLIC PRESALE:

The presale goal is to raise a maximum of 83 Ethereum without a minimum. Savix is privately funded and already shows a working product with (internally) audited smart contract. Contributions of the initial presale will be used for next developments, external audit(s), marketing and partnerships.

Unsold tokens will be moved on to the next presale phases.

Presale Exchange Rate: 1 ETH = 60 SVX

Adjustment on Feb 4th 2021: Additional bonus of 10% (10SVX/ETH) taken from ecosystem fund

Token contract address: 0x8a6e8e9f7d61e97bde7e66336dbeea4fcbb388ae

Presale will complete on Feb 8th 2021 or when the maximum amount of ETH is raised.

Minimum Contribution: 0.1 ETH

Maximum Contribution: 15 ETH

•Uniswap Liquidity Pool •

Shortly after the presale we will list Savix on Uniswap for public trading.

Initial Price: 1 ETH = 50 SVX

Estimated Liquidity (Presale Goal Reached): ~ 800.000 – 1.000.000 USD (Depends on Ethereum volatility)

Estimated Market Cap: ~ 1.800.000 - 1.900.000 USD

The Uniswap Pool will be locked for 6 month, long enough to build trust with the community. Locking the pool longer than necessary represents a certain risk to the liquidity in case the Savix contract needs to be updated or migrated in the future.

More information about the project:

Website: https://savix.org

Telegram: https://t.me/savix_org

Twitter: https://twitter.com/savix_org

White Paper: https://savix.org/wp -content / uploads / 2020/11 / SAVIX_Whitepaper.pdf

Medium: https://anatol69.medium.com

Github: https://github.com/SavixOrg

Forum Username: syedrasool2020

Forum Account Link: https://bitcointalk.org/index.php?action=profile;u=2278993

Comments

Post a Comment