LEND: Opens up the possibility of lending and borrowing crypto assets

Introducing LEND

LEND is a decentralized financial ecosystem that aims to reduce the gap between crypto and fiat currencies so that users can freely exchange between the two. LEND is a blockchain-based, peer-to-peer lending platform that focuses on transparency and security. It seeks to provide a better experience for both lenders and borrowers. The main purpose of LEND is to make sure that both parties have a satisfying experience on the platform. The platform also seeks to make sure that both parties have a safe experience on the platform.

LEND will be using blockchain technology to ensure that there are no security flaws that would compromise the safety of either party. LEND also seeks to make sure that both parties have a satisfying user experience. The platform will be optimized to make sure that both parties are comfortable throughout the lending process. LEND will deliver a great experience for both parties. LendLedger is a decentralized lending ecosystem. In other words, it is a peer-to-peer lending platform.

Goal of $LEND

The main purpose of $LEND is to be the top stable token of all cryptocurrency. $LEND is a a global lending network built on top of the blockchain. We are a decentralized peer to peer lending platform that connects borrowers, lenders and co-signers (credit guarantor) across the globe. $LEND is managed by the $LEND foundation based in Liechtenstein. This foundation grants loans to borrowers, who are rated by the $LEND reputation-based lending system and default on their loans, thereby creating an opportunity for lenders to obtain an interest on their loan. The $LEND platform is designed to be a decentralized application (DApp) built on top of the blockchain.

The goal of $LEND is to promote financial inclusion and increase access to credit for borrowers and investors. The primary goal of $LEND is to provide a decentralized, global and inclusive ecosystem of lending services. Our goal is to help the unbanked, underbanked and the rest of the world access the benefits of lending services. We are starting with the fintech industry where most of the unbanked and underbanked reside. We plan to expand into other industries by providing lending services.

Why LEND?

Lending protocols are not new to the DeFi ecosystem and there are many established protocols with multi-billions of dollars in value captured. By January 2022 the Total Value Locked (TVL) was well over $170 billion! Despite the DeFi space being very much in its infancy, that is still a tremendous amount of value captured by protocols that are still generally, overly complicated and very difficult for the average user to get onboarded. LEND aims to simplify this process and achieve financial inclusion for everyone. Providing true value to our users with no barriers to entry.

LEND was also designed to reward users with 'real yield' to create a sustainable and beneficial model to the entire TEN Finance ecosystem. LEND will use the platform's native token; $LEND, to distribute actual revenue generated back to our users. This feature will ensure LEND is free adapt and evolve alongside the DeFi space by ensuring we give real utility to $LEND.

Key Features of LEND:

- Lending — Supply assets to the protocol to earn interest

- Borrowing — Supply assets as collateral to borrow crypto

- Governance — Vote on important future protocol decisions

- Earning — Earn 25% of all platform revenue with $LEND tokens

- MultiChain — Launching on BNB Chain, Eth & Polygon with framework complete for many other chains. Each chain means an additional stream of revenue to be earned by $LEND token stakers.

Why do you need LEND

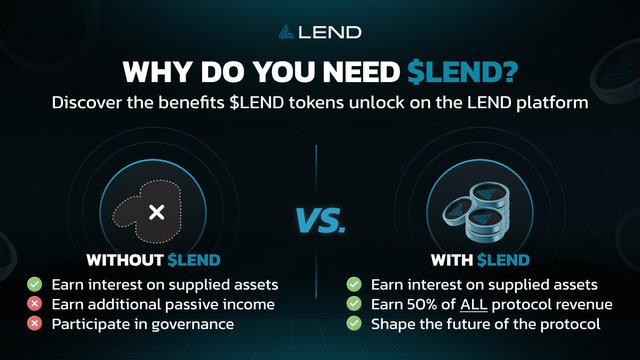

$LEND tokens will be the native token for the LEND protocol. Within the token structure, the token will give holders governance and voting rights in important decisions for shaping the future of the platform. It doesn’t end there though…

$LEND tokens are also the key to earning passive income from the protocol. Once the token has launched, holders can supply $LEND to the protocol in exchange for $tLEND which actually makes them eligible to claim 25% of the total revenue generated by the protocol! 25% more than any current existing protocol! Can Venus do that?

$tLEND tokens can also be staked or locked by users to earn additional Platform Reward Fees based on a 90-day vesting schedule. Locking tokens for the full 90-day term means an increased share of protocol revenue will be received.

LEND Safety Features:

- Security Audit — Industry leading experts at Peckshield have reviewed and approved LEND smart contracts multiple times.

- Collateral Requirement — All borrowers required to be overcollateralized for optimal liquidity within protocol. This means users have to provide more collateral than they are able to borrow.

- Only Liquid Assets — LEND will only ever support the most liquid assets on the market. This has been done to avoid protocol manipulation that might result in total systemic failure. (Like Mango)

- Automated Liquidations— Unhealthy borrower accounts that go into negative equity will be liquidated by the protocol to remove bad debt.

How LEND Operates

In the LEND ecosystem, every asset the Protocol supports has a tTokenized version of the particular asset. So when an investor supplies an asset, they would receive a tTokenized version of it. Using USDT as a case study, if an investor provides USDT for Lending, he would receive $tUSDT. The investor is able to automatically earn interest as the tToken he possesses is used to create borrow balances by other participants on the protocol. It is also imperative to note that when supplying tTokens, the basic amount of tTokens supplied would increase in value over time in the likes of a savings account. The proprietary tTokens are required when apportioning collateral to establish a borrow balance.

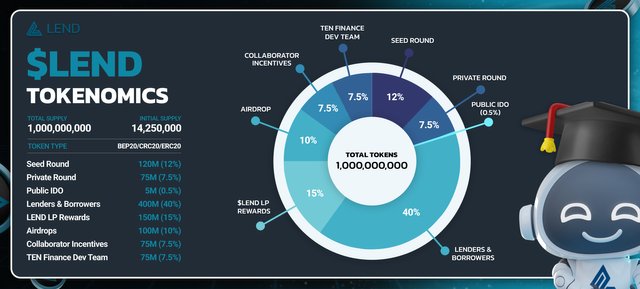

Tokenomics

- TOKEN SYMBOL: LEND

- TOKEN TYPE: BEP20/ERC20

- TOTAL SUPPLY: 1,000,000,000

- INITIAL SUPPLY: 14,250,000

- INITIAL MARKETCAP: TBA

ROADMAP

Conclusion

LEND will have a huge impact on the lending industry by disrupting it by following global trends that are changing the way we manage our finances. The main purpose of $LEND is to provide a set of comprehensive financial services that allow to gain access to the crypto market, to earn profits on the growing crypto market and to be in demand in the crypto market. Lenders and Borrowers of crypto assets will interact directly with the protocol in either earning or paying a floating interest rate. The benefit of being decentralized means this is all done without the need to negotiate terms of maturity, interest rate or collateral with any peer or counterparty!

For More Information:

Website: https://www.lend.finance/

Whitepaper: http://lend.gitbook.io/

Telegram: http://t.me/lendfinance

Twitter: http://twitter.com/lend_finance

Github: https://github.com/tenfinance

Medium: https://medium.com/lendfinance

BTT Username: majnokhan2021

BTT Profile Link: https://bitcointalk.org/index.php?action=profile;u=3437384

Comments

Post a Comment